Cookbook events

Cookbook events

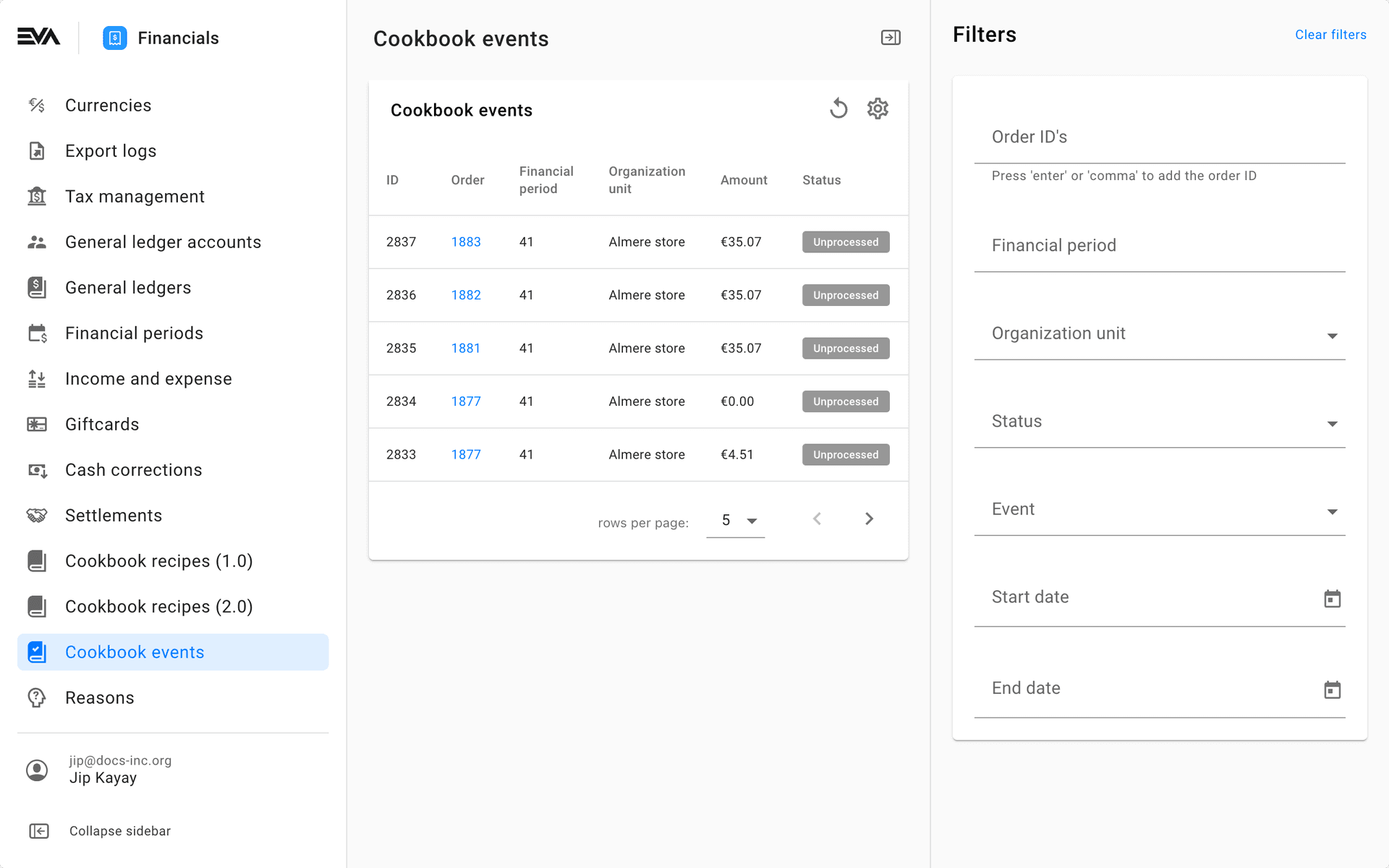

Reset, process, or view cookbook eventsThe Cookbook events chapter is used to reset, process, or view cookbook events pertaining to a specific financial period, organization unit, order ID, and more.

In order to be able to access this chapter, you need the FinancialEvents functionality.

Overview

The initial chapter overview provides a birds eye view of all cookbook events regardless any filters so, make use of those filters on the right sidebar to narrow down your results if needed.

Each cookbook event is hyperlinked to the corresponding order (if applicable). Clicking the order will navigate you to that orders Order detail page.

The filter fields are quite self-explanatory on what to expect if used (combining filter fields is possible for additional fine-tuning of your overview results).

Event status

A Financial event has one of these possible statuses:

| Status | Description |

|---|---|

| Unprocessed | The event was recently created and hasn't gone through cookbook yet. |

| Processed | The event was successfully booked into one or more general ledger entries. |

| Ignored | The event was intentionally ignored. |

| No processing required | The event doesn't require processing, for example when the event was created for an OrganizationUnit that does not create financial bookings. |

| No matching recipe | There is no matching recipe for this financial event type, so it's currently falling through the cracks or maybe not. It should either be explicitly ignored, or a recipe has to be created for this type of event. |

Event types

All financial events have a certain type for which a recipe can be created. The following are all possible event types:

Sales

SalesTax

SalesDiscount

Purchase

PurchaseTax

PurchasePriceVariance

PurchaseInvoiceDispute

PurchaseInvoiceDisputeResolved

PurchaseDiscounts

CostOfGoods

Payment

PaymentEndRounding

PaymentSettlement

PaymentCapture

CashAdjustment

StockSold

StockReceived

Shipment

StockMutation

A Stock Mutation event is generated when stock is mutated in EVA. The amount of a Stock Mutation in such event is equal to the value of the moved stock, according to the unit cost of the product, multiplied by the number of products mutated.

Stock Mutation Reasons

Stock Mutations are a special kind of event, caused by a mutation of the stock on a particular organization unit. Each mutation bears a reason, on which additional bookings can be made.

List of reasons

- Unknown

- ChangeOrganizationUnit

- Correction

- Damage

- Theft

- Movement

- CycleCountDeviation

- Sold

- Received

- Returned

- DOA

- Scrap

- InternalUse

- Demo

- SentToVendor

- InitialInventory

- UndoOrderReservation

- CreateOrderReservation

- CreateReturnRequestStock

- ReceiptDeficiency

- Revaluation

- InventoryReset

- CancelReturnRequestLine

- ReservationSurplus

- ShopClosingReturns

- SentBySupplier

- ExternalModification

- Interbranch

- ReturnToSupplier

- ReceiptSurplus

- ShipmentCancelled

- PurchasePriceVariance

- FullStockCount

StockMutationAutomaticCorrection

Creation of a stock mutation results in a negative stock balance (for example: an item was sold that according to EVA has no stock), thus an additional stock mutation event is created to adjust the stock back to zero. The financial result of this is registered as a Stock Mutation Automatic Correction event.

(Re)processing financial events

The filters set at the time of (re)processing will be applied in the request payload.

Processing financial events is as simple as clicking the 'Gears' icon on the top right of the Cookbook events card.

On other hand, reprocessing requires a few steps:

Step 1: Specify the events you wish to reprocess events for by using the fields available in the filter sidebar

Step 2: Click the Reset button located on the top right.

Once the reset is complete, you can now refresh the window. You'll notice that the status is now shown as Unprocessed instead of a Processed status prior to the reset.

Step 3: Click the 'Gears' icon on the top right to process the filtered events. By doing this, you'll reprocess the financial events once again, but this time against a possible updated Cookbook setup or recipe. A new export file is now also available for your middleware i.e. for your ERP system.

Using the Reset or Process functionality might take a few minutes to conclude. You'll be notified via email once the reset is done.

Event status resetting

Clicking the 'Reset' icon on the top right of the Cookbook events card will reset the financial event(s) status to Unprocessed and will clear the associated ledgers.