Cookbook recipes

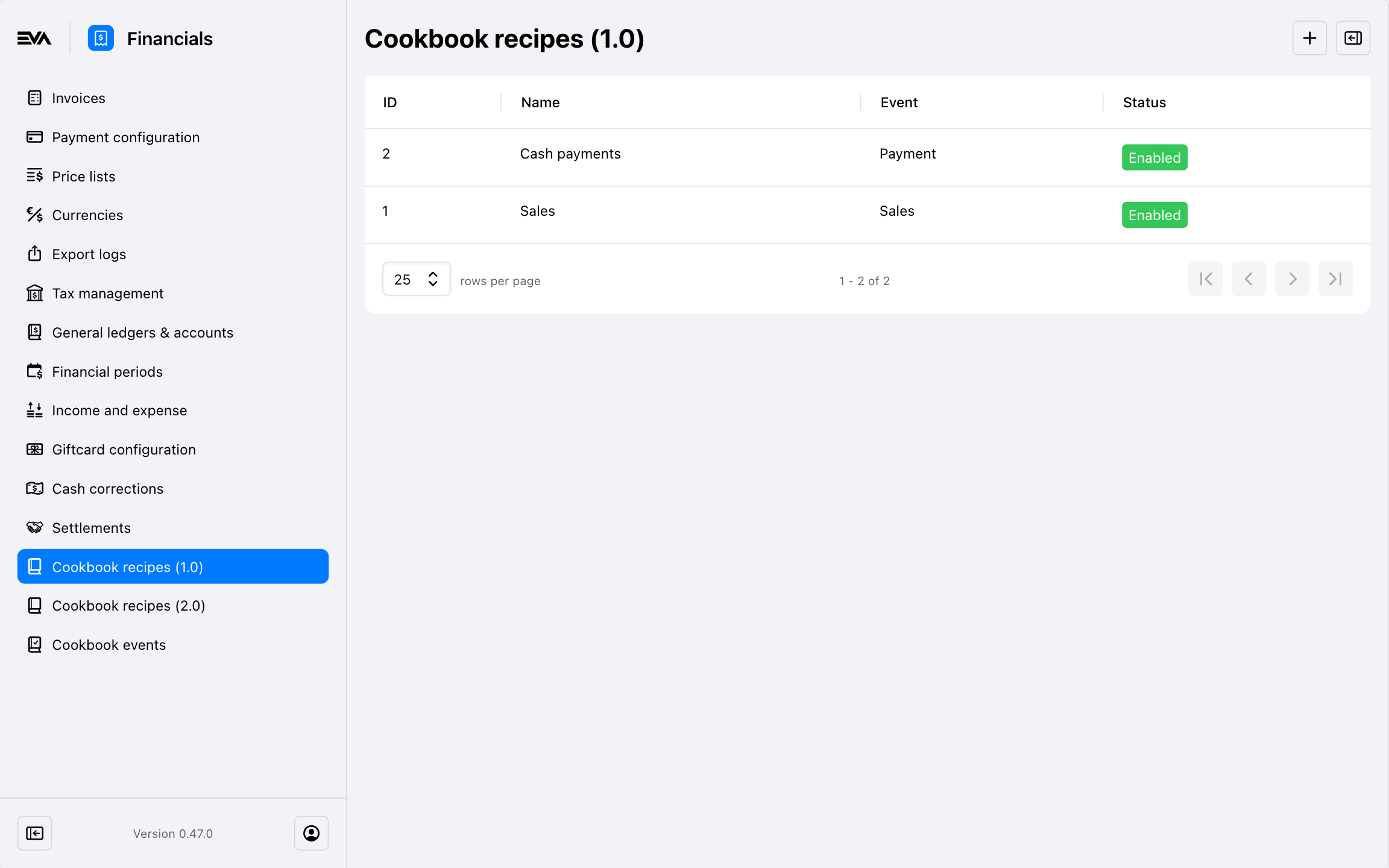

The Cookbook recipes (both 1.0 and 2.0) chapter gives you a complete overview of all your configured recipes. Most of this chapter's functionality is very straightforward, so we'll only go into it briefly before going into detail with actual recipes.

The overview shows you each recipe's event type and if it's currently active. You can click +Add in the top-right corner, or an existing recipe, to open up the recipe editor.

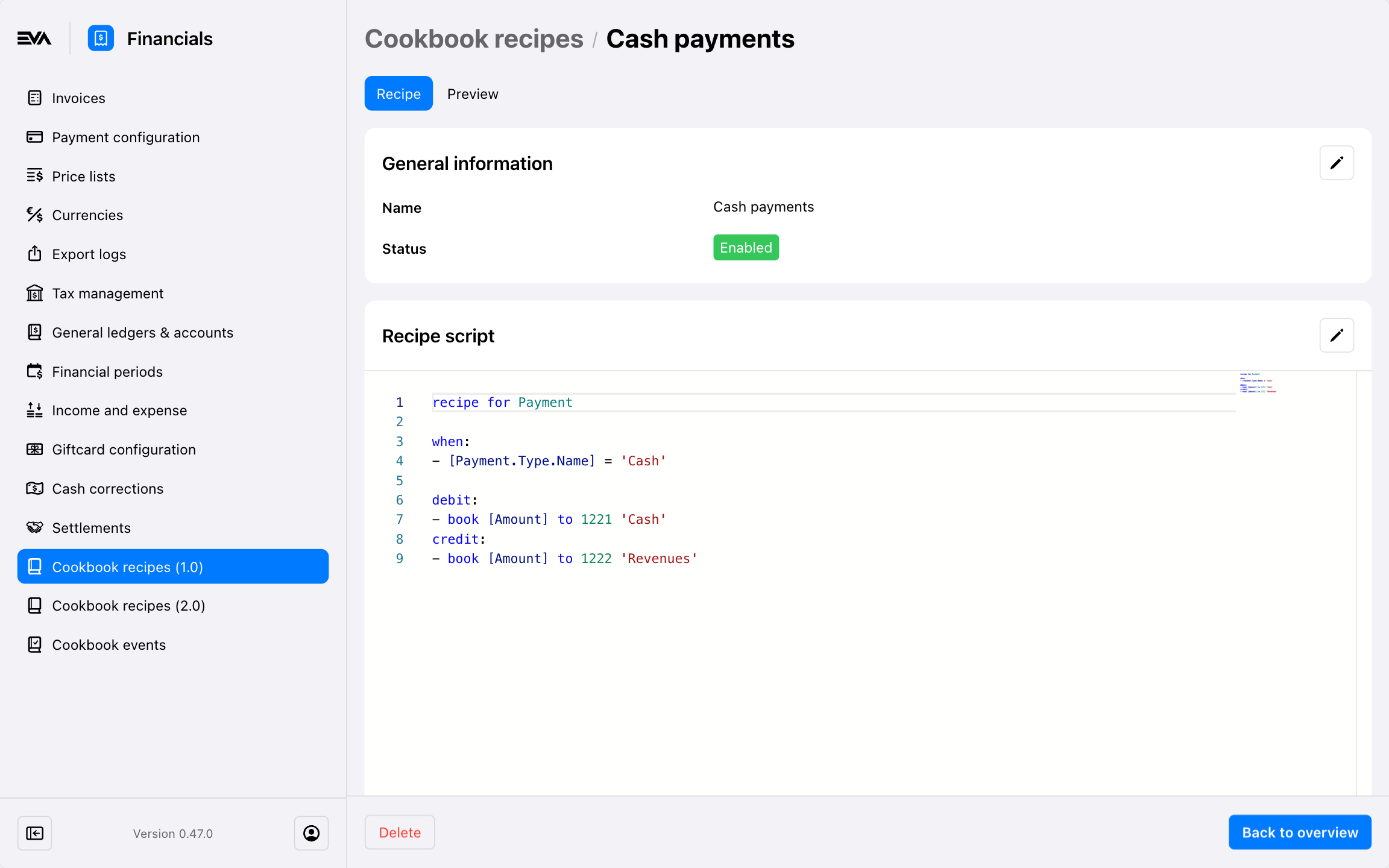

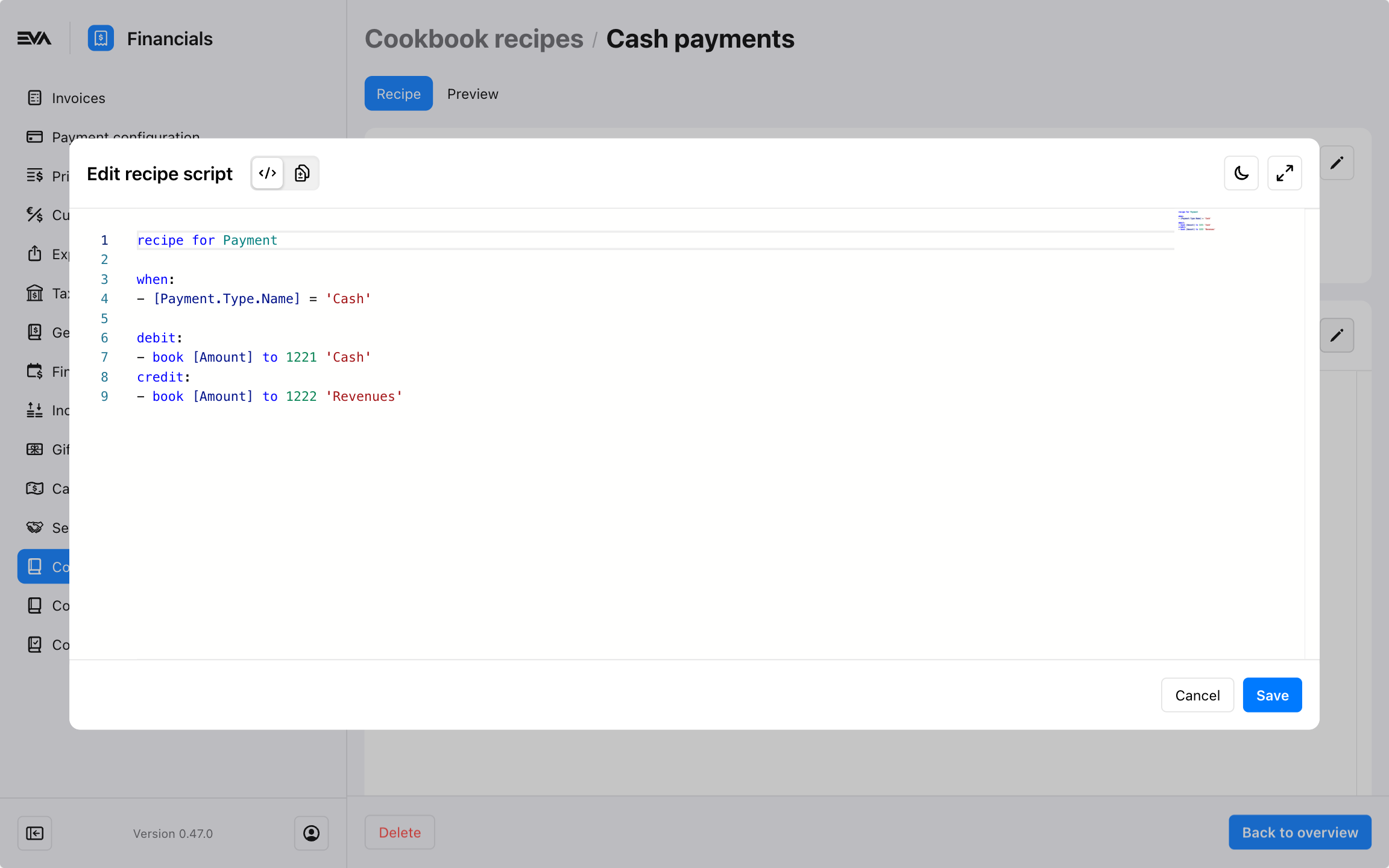

Once inside a recipe, you can start editing the details and most notably, start writing Code for the recipe.

By clicking the 'pencil' icon, a new modal will open up where you can also edit the recipe's code, while offering a few more tools for your disposal. These include night mode and a comparison of the edits you're making to the current version.

Clicking the Recipe history button in the comparison modal, will call for the service GetAccountingRecipeHistory, giving you the recipe history.

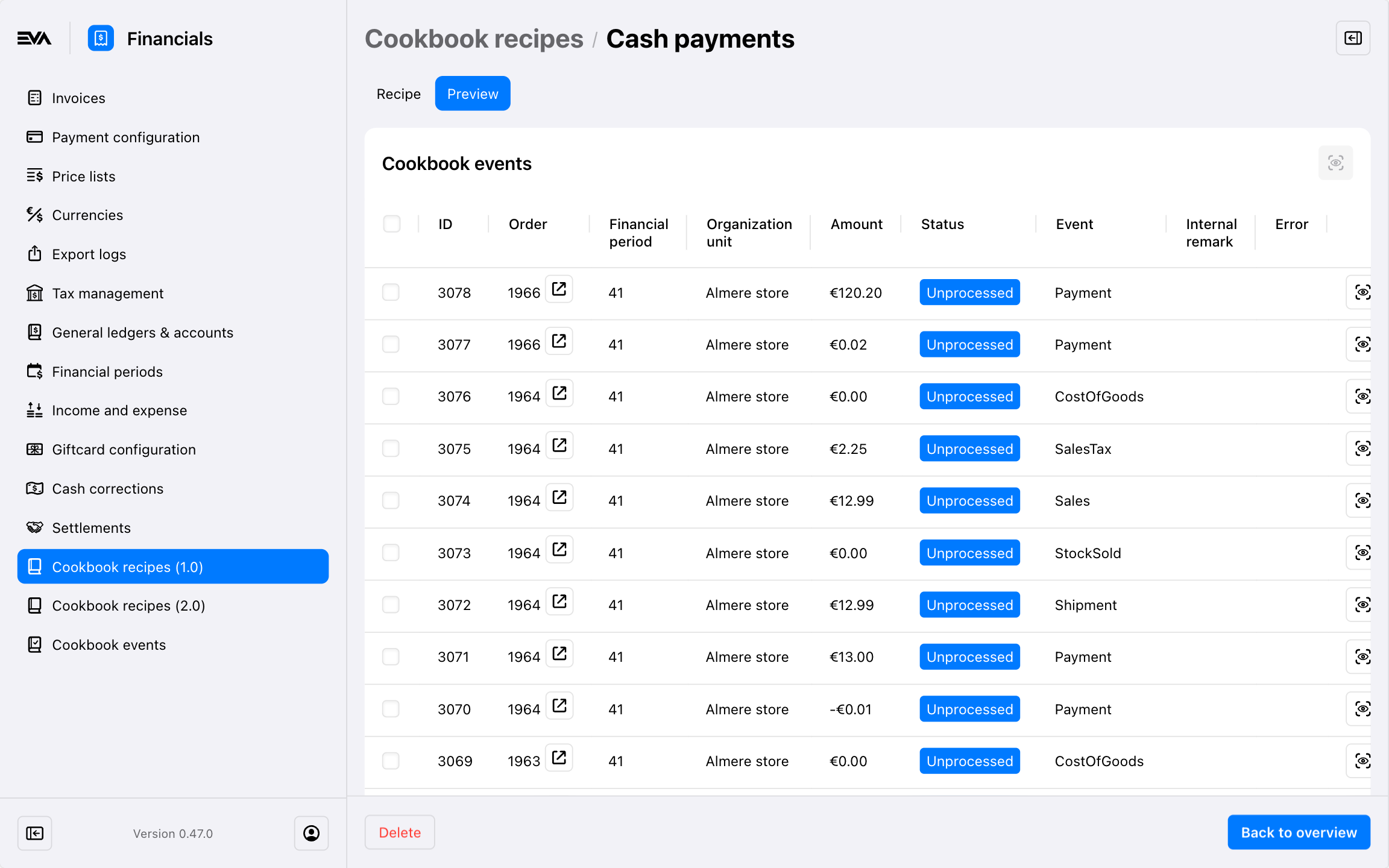

Each recipe has its own Preview tab, which allows direct access to the Cookbook events. The events listed are the same as the ones listed in the Cookbook events chapter, with one big difference: each line holds a Preview button.

By clicking it a modal will be displayed with the result of all active recipes. It contains both a Summary and a Details table.

The latter describes the result of each financial event and the summary shows what will eventually be exported (in other words: the totals per grand ledger). Offsets are included in this modal as well.

Recipe concepts

Now that we've covered this chapter's basic functionality, let's head on over to the recipes.

Let's first go over the most basic form of a recipe again:

recipe '<OptionalRecipeDescription>' for <FinancialEventType>

debit:

- book [Amount] to <AccountNumber> '<OptionalAccountDescription>'

credit:

- book [Amount] to <AccountNumber> '<OptionalAccountDescription>'

- book is followed by a variable, usually [Amount]. This can also be a calculation or a plain number, as long as the line produces a valid number to book.

- A recipe doesn't mind a little whitespace, use as many as you like.

- The total sum of credit bookings must always match the total sum of debit bookings. That's basic accounting, even we know that.

Variables

Any variables that are contained in a financial event can be used in the events corresponding recipe. In a recipe, anything inside block quotes is a variable.

Commonly used variables are:

[Amount][Payment][OrganizationUnit]

Variables also contain sub-variables. There are many sub-variables that can be created. For example, an organization unit has a name, which can be referred to using [OrganizationUnit.Name], but you might also use its BackendID or even set a custom field to initiate a split; it would look something like this: OrganizationUnit.CustomField.XXX, while the X's refer to the custom field name. Custom fields can be created under using the respective Custom fields chapter in Admin Suite.

Essentially, any information related to a financial event can be used as a variable. For example, a Sales event relates to an order, this basically means that you can use any property on the order as a variable, like Order.SoldFromOrganizationUnit.CountryID.

Since every Cookbook recipe has a different purpose, please keep in mind that each recipe in Cookbook has different properties available to it.

Reminder: Order line types

As a reminder for the often used OrderLine.Type property in Cookbook recipes, the following types are available.

Conditions

A recipe can use when conditions to further specify what events beyond the event type it applies to. An example:

recipe for Payment

when:

- [Payment.Type.Name] = 'Cash'

debit:

- book [Amount] to 2065 'KAS'

credit:

- book [Amount] to 2400 'EVA'

else when:

- [Payment.Type.Name] = 'PIN'

debit:

- book [Amount] to 2075 'MSP'

credit:

- book [Amount] to 2400 'EVA'

else when:

- [Payment.Type.Name] = 'Rounding'

debit:

- book [Amount] to 3300 'Differences'

credit:

- book [Amount] to 2400 'EVA'

Above recipe performs different entries depending on type of payment used. Conditions always use some sort comparison for example, in the above recipe the [Payment.Type.Name] was being compared with actual payment type names.

When evaluating what action to execute for an event the first valid match is always chosen, they are simply evaluated from top to bottom and the action of the first match is executed.

Comparisons

A number of symbols can be used to make comparisons:

| Symbol | Comparison |

|---|---|

= | Left and right must be equal |

<> | Left and right must not be equal |

> | Left must be greater than right |

< | Left must be smaller than right |

>= | Left must be greater or equal to right |

<= | Left must be smaller or equal to right |

in | Can be used to check if something is one of a number of things. Example: [Payment.Type.Name] in ['PIN', 'CASH'] |

has value | Some variables are optional. For example, an Order might not always have a Customer. This can be used to check if it does. Example: [Order.Customer] has value |

has no value | The opposite of has value |

Calculations

The amount for a debit or credit booking can contain calculations for example, you might want to book a 2% kickback to some party in your sales entry. Here is how it would look like:

credit:

- book 0.98 * [Amount] to 7800 'Revenue'

- book 0.02 * [Amount] to 3400 'Kickback'

Ignoring

Some Financial Events bear no financial impact. In such scenarios, here is how you can set such an event. Example:

recipe for StockMutation

when:

- [OrganizationUnit.Name] = 'Warehouse'

debit:

- ignore

credit:

- ignore

This would ignore all Stock Mutation events that happen inside the organization unit "Warehouse".

Overrides

Inside a recipe, you can override some values on the resulting booking. The fields that can currently be overridden are:

- TaxCodeBackendID

- Remark

- Reference

- Offset 1

- Offset 2

- Offset 3

- Offset 4

- Offset 5

- Offset 6

You can override a value like this:

credit:

- book [Amount] to 7800 'Revenue' with 'AN68' as [TaxCodeBackendID].

This will then result in the following booking:

{

"CurrencyID": "HTG",

"AccountName": "Revenue",

"AccountObject": "7800",

"TaxCodeBackendID": 'AN64',

"Offset1": null,

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": -1812.25,

"Remark": null,

"Reference": null

}

Functions

Functions can be used to create more complex conditions. Essentially, functions are predefined conditions.

A function can look like this:

with [isEuCountry] as:

- [Order.BillingAddress.CountryID] in ['AX','AT','BE','BG',

'HR','CY','CZ','EE','FO','FI','FR','GF',

'DE','GI','GR','HU','IE','IM','IT','LV','LT',

'LU','MT','NL','PL','PT','RO','SK','SI','ES','SE','GB']

In this function, we have created a condition that checks whether the CountryID on the BillingAddress is that of a European country. The function can be called in the recipe as follows:

when:

- [isEuCountry]

Offset

Cookbook entries are consolidated per account to derive total amounts for each. To break such amounts down into more detailed bookings, use Offset.

To illustrate, let's use the following recipe:

recipe for Sales

debit:

- book [Amount] to 1111 'EVA'

credit:

- book [Amount] to 2222 'Revenue'

With this recipe in place, we will open a financial period and perform three different transactions of the following values:

- 1812,25

- 3624,50

- 7249,00

We then close the financial period. The resulting export will look like this:

{

"OrganizationUnit": {

"BackendID": "tortuga_store",

"BackendCompanyID": null,

"Name": "Tortuga Store",

"TimeZone": "Etc/GMT-5",

"CurrentOffset": 300

},

"Period": {

"ID": 24,

"Number": null,

"OpeningTime": "2021-06-09T08:02:47.7Z",

"ClosingTime": "2021-06-09T08:05:27.43Z"

},

"Entries": [

{

"CurrencyID": "HTG",

"AccountName": "EVA",

"AccountObject": "1111",

"TaxCodeBackendID": null,

"Offset1": null,

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": 12685.75,

"Remark": null,

"Reference": null

},

{

"CurrencyID": "HTG",

"AccountName": "Revenue",

"AccountObject": "2222",

"TaxCodeBackendID": null,

"Offset1": null,

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": -12685.75,

"Remark": null,

"Reference": null

}

]

}

As you can see, the amounts are consolidated into totals:

1812,25 + 3624,50 + 7249,00 = 12685,75

If we update our recipe with an Offset for [OrderLine.ID], we can break that amount down into order lines by using their respective ID's. Here is how it would look like:

recipe 'sales test' for Sales

debit:

- book [Amount] to 1111 'EVA'

with [OrderLine.ID] as [Offset1]

credit:

- book [Amount] to 2222 'Revenue'

with [OrderLine.ID] as [Offset1]

Now, when we open a new financial period, perform the same order, and close the financial period; your export would look something like this (note the Offsets impact on how it now looks compared to the one without above):

{

"OrganizationUnit": {

"BackendID": "tortuga_store",

"BackendCompanyID": null,

"Name": "Tortuga Store",

"TimeZone": "Etc/GMT-5",

"CurrentOffset": 300

},

"Period": {

"ID": 26,

"Number": null,

"OpeningTime": "2021-06-09T08:20:56.913Z",

"ClosingTime": "2021-06-09T08:22:14.697Z"

},

"Entries": [

{

"CurrencyID": "HTG",

"AccountName": "EVA",

"AccountObject": "1111",

"TaxCodeBackendID": null,

"Offset1": "231",

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": 1812.25,

"Remark": null,

"Reference": null

},

{

"CurrencyID": "HTG",

"AccountName": "Revenue",

"AccountObject": "2222",

"TaxCodeBackendID": null,

"Offset1": "231",

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": -1812.25,

"Remark": null,

"Reference": null

},

{

"CurrencyID": "HTG",

"AccountName": "EVA",

"AccountObject": "1111",

"TaxCodeBackendID": null,

"Offset1": "232",

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": 3624.5,

"Remark": null,

"Reference": null

},

{

"CurrencyID": "HTG",

"AccountName": "Revenue",

"AccountObject": "2222",

"TaxCodeBackendID": null,

"Offset1": "232",

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": -3624.5,

"Remark": null,

"Reference": null

},

{

"CurrencyID": "HTG",

"AccountName": "EVA",

"AccountObject": "1111",

"TaxCodeBackendID": null,

"Offset1": "233",

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": 7249,

"Remark": null,

"Reference": null

},

{

"CurrencyID": "HTG",

"AccountName": "Revenue",

"AccountObject": "2222",

"TaxCodeBackendID": null,

"Offset1": "233",

"Offset2": null,

"Offset3": null,

"Offset4": null,

"Offset5": null,

"Offset6": null,

"Amount": -7249,

"Remark": null,

"Reference": null

}

]

}

As you can see, debit and credit bookings are now broken down per order line ID.

Make sure the ledger account used isn't configured as WithoutOffsets if you want to use offsets.