Tax management

Tax management

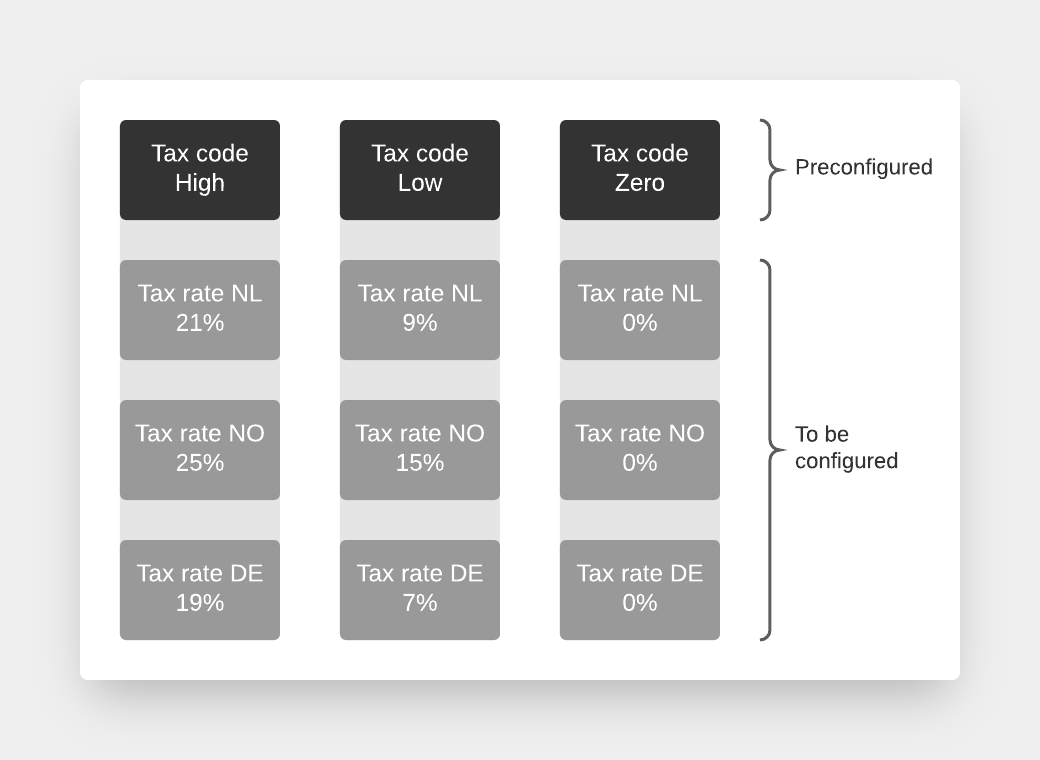

All about taxes taxes taxesBy default, EVA knows five tax codes (brackets):

- High

- Intermediate

- Low

- Zero

- Exempt

Virtually every country uses these tax codes, but the actual rates of the codes may differ. For this reason, country-specific rates can be defined for each tax code.

For example, clothing falls within the High bracket, so when creating a clothing product, the tax code High is selected. When this product is sold in "The Netherlands", the High rate for NL is applied, which is 21%. When this product is sold in "Germany", the High rate for DE is applied, which is 19%.

Basically, a single tax code can contain a tax rate for every individual country. Using this hierarchical structure when creating products, you only have to attach a tax code instead of different tax rates for different countries.

Tax calculations across country borders

To make international tax calculations more dependable, we've added a new way of calculating them. This can be enabled with the Orders:UseNewCalculation setting.

Using this new way of calculations will;

- Take the Unit price including VAT as the basis for its calculations;

- Group All order lines by their respective VAT rates, to ensure rounding is used as little as possible;

- Put the calculated tax amount on the lines divided by ratio, with any remaining cents that need to be put "somewhere" added to the tax amount of one of the lines in that VAT rate grouping.

Note: once this setting has proved itself in the wild, it will become the new standard way of making tax calculations.

Concept illustration

Goes without saying, your tax configuration won't make sense unless you have products in place. Each product is then assigned a tax code/category which you create:

Each tax code/category is defined by a country where it would be applicable, and the actual tax rate that is to be applied on the respective product or service being sold in that country.

You will notice in our example illustration here that the same tax category can be tagged to several countries. Yes, it's possible. It's how it should actually look like if you operate in more than one country. This gives you flexibility to modify the tax rate based on each countries tax laws.

EVA then takes your tax structure into account when creating pricelists (including or excluding tax).

Then everything comes together! A customers basket summary displays applicable taxes based on your tax configuration, and subsequently the issued receipt/invoice breakdown.

For tax configurations, go to:

Considerations for initial setup

✔ Create tax codes

✔ Upload your Product Master Data

✔ Map your Product Master Data to Tax Codes

✔ Create tax rates for each tax code (this is done per country)

✔ Upload pricelists for your products - ensure to specifiy if they are in-tax or ex-tax

✔ Do you operate in countries using Avatax?

» Yes: then you need to categorize your EVA product master data Tax Codes in the categories used by Avalara

» No: then you can categorize your products using universal Tax Codes, HS-codes for example.