🇮🇪 Ireland

Ireland

A configuration guide to being compliant in IrelandThis document provides a step-by-step configuration guide for a compliant setup in Ireland.

Compliance in Ireland at a glance

Which flows are affected?

Which type of fiscalization is required?

Who needs certification?

Introduction

When it comes to real-time sales posting, there are no mandatory software integration or hardware requirements in this country. Nevertheless, businesses are obliged to provide their transactions and invoices to authorities and auditors upon request. Therefore, the settings and configurations enlisted here will ensure that the correct docs are generated at the right time with proper invoice sequencing.

Special considerations

A few considerations need to be taken into account when it comes to the Irish compliancy configurations, as follows:

Local mode support

Local mode is currently not supported by EVA in Ireland. Activating local mode is done at your own discretion and risk. We strongly recommend conducting thorough testing of local mode before going live to ensure it aligns with your expectations.

If you require support for local mode, please submit a JIRA development ticket, namely a request for change.

Unreferenced returns

Unreferenced returned orders are permitted (a return that is not linked to an original order sold via EVA).

However, when creating an unreferenced return, EVA will require you to enter the order number and sales date of the original sale to which this return will reference. If you are migrating from an old POS system, you can enter the order number and date from the receipt of the original sales order. This data is necessary to demonstrate to authorities that you are not simply returning items, which could be perceived as a sign of tax evasion.

Anti Money Laundering

- Cash Payments: For sectors like high-value goods, cash transactions over €15,000 are reported through the use of a Suspicious Transaction Report (STR) to the Financial Intelligence Unit (FIU) of the Garda Síochána and the Revenue Commissioners.

- Suspicious Activity: Any suspicious transactions, regardless of amount, must also be reported using an STR form to the FIU and Revenue Commissioners.

Step-by-step configuration

This is a step-by-step guide to configurations that need to be performed within EVA for a compliant setup in Ireland. The steps should be followed in the same order as presented hereunder.

Step 1: Setting up a Company on EVA

A company needs to be created in EVA, this can be done via the Admin Suite under the Companies chapter.

Your company in this essence serves as the countries top-level legal entity, which will then house all your stores, creating a hierarchical set-up that would then inherit configurations.

Make sure the following fields are filled in:

- Name

- VAT Number

- Registration Number

- Address (VisitorAddress)

- Street

- HouseNumber

- ZipCode

- City

- CountryID

Irish VAT numbers have the prefix "IE" followed by eight or nine characters. The format can be one of the following:

- IE1234567W: 7 digits + 1 letter (the old format)

- IE1W23456L: 1 letter + 6 digits + 1 letter (the current standard format)

- IE1234567FA: 7 digits + 2 letters; (a newer format, usually for special cases only)

Step 2: Create your store(s)

Now that you have a company in place, you need to attach it to Organization Unit of type Store.

Creating those can be done via the Admin Suite under the Organization Unit chapter.

Make sure the following fields are filled in:

- Name

- BackendID (store number)

- Address

- Street

- ZipCode

- City

- CountryID

- CompanyID (Make sure to select the company you've created in Step 1)

Additional step for multiple stores

In scenarios where multiple Organization Units/Stores operate in the same country, a grouping should first be done to ease setting inheritance.

The grouping can be done by creating an Organization Unit of type Container. This Organization Unit type can be created in the same way i.e. via the Admin Suite under the Organization Unit chapter but this time, select the Organization unit type as Container & Country.

Once created, attach all your stores (Organization Units of type Store) under the created Container for this country.

Step 3: Create stations

For the Organization Unit(s) of type Store where transactions will be performed, you'll need to create Station(s) for each (if applicable). Adding a station can be done by following the steps here.

When creating the Station(s), make sure the following fields are filled in:

- The underlying Organization Unit where the station will be used i.e. attached to the OU of type Store.

- The station name.

- The box This station is a fiscal station and will be used for transactions needs to be checked.

Step 4: Check payment types

For transaction reporting, EVA groups your payment types into a number of predefined categories (e.g. Cash, Credit, Voucher, Online, etc.). To perform transactions, ensure that all Payment types you offer in this country have a Payment Category defined. Payments are configured via the Admin Suite under the Payment methods chapter -> Payment Types -> Payment Category field.

Step 5: Settings for auditing provider and invoices

The following settings need to be added. This can be done via the Admin Suite under the Settings chapter.

| Setting | Value | Organization unit | Description |

|---|---|---|---|

| Auditing:Provider | IE | IE on store OU's when go-live is in phases or on country level for a big bang go live. | Sets the certified aspects |

| UseInvoiceOutputFacade | true | Root level (store OU) or Container level | Attaches the Certified Invoice PDF when emailing the Invoice from our frontend App. This setting enables the use of the CertifiedInvoice stencil with destination Mail |

| AllowConsumerInvoices | true or false (default: false) | Root level (store OU) or Container level | When set to true, enables automatic generation of PDF invoices for B2C sales. |

| IgnoreConsumerInvoiceFiscalIDRequirement | true or false (default: false) | Root level (store OU) or Container level | When set to true, permits issuing B2C invoices without a fiscal ID, regardless of the invoice amount. |

Settings for e-commerce

Please configure the following setting specifically on your e-commerce OU:

Auditing:Provider- IE

By doing so, EVA will implement the following logic automatically:

- Output documents

- Document sequencing

- Certified Stencils

Step 6 (optional): Auto open close financial period

This is an optional step where you can configure auto open and close of your financial period.

Step 7: Stencils

This step impacts what your certified invoices (thermal & PDF) will look like.

For setup instructions and additional information on Certified Invoices, please visit the Certified Invoices documentation page. To attach a certified invoice to an email, a separate stencil is necessary. You can find the configuration details for this stencil on the same page.

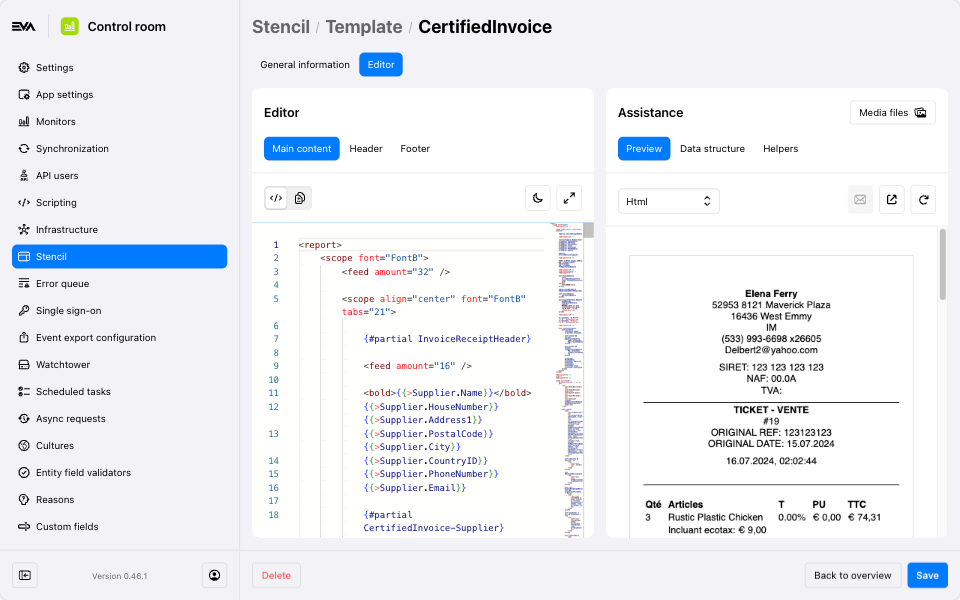

You can generate a preview of your PDF invoice or Thermal Receipt using the Stencil chapter. Remember, the order details in the preview will be substituted with the actual order information. Additionally, we advise printing a real PDF invoice and thermal receipt during your testing, and to not rely solely on this preview feature.

Stencil Preview Feature

Below is an example of the CertifiedInvoice template preview found in the Stencil chapter of Admin Suite.

Step 8: Validation & testing

Now is a good moment to validate and test your setup, as follows:

Validation

Once you're done with all configuration steps. Make sure to use the Validate audit configuration button to check if any compliance-related configurations or data is missing or successfully configured.

Testing

Start placing some orders and check the following:

- Invoice output and numbering

- Thermal receipts output

- PDF invoice output

Step 9: Fiscal archiving & audit files

There are no compulsory regulations set by Irish authorities when it comes to creation of Audit files. However, tax registered entites are obligated to maintain comprehensive records. This includes the retention of detailed information regarding all goods and services rendered to taxable parties.

To facilitate swift retrieval of such records for submission to tax Authority (if needed), our white label audit files can be used. The audit file(s) include an overview of underlying tax information/operations readily available upon any requests from the authorities (file is in JSON format).

More on generating Audit files can be found here.

To enable printing of X/Z reports, a stencil called TerminalReport is used.

Sample stencil

<report>

<scope bold="true" align="center">

{{>Document.Type == 0 ? 'X Report' : 'Z Report'}} {{if Number && Number > 0}}#{{>Number}}{{/if}}

</scope>

<feed amount="32" />

{{if Document.Supplier}}

<scope align="center">

{{>Document.Supplier.Name}}

{{if Document.Supplier.Address}}

{{>Document.Supplier.Address.Address1}} {{>Document.Supplier.Address.Number}}

{{>Document.Supplier.Address.Address2}}

{{/if}}

{{>Document.Supplier.PhoneNumber}}

{{>Document.Supplier.Email}}

{{if Document.Supplier.EstablishmentNumber }}

Establishment number {{>Document.Supplier.EstablishmentNumber}}

{{/if}}

{{if Document.Company}}

{{if Document.Company.RegistrationNumber}}

Registration number: {{>Document.Company.RegistrationNumber}}

{{/if}}

{{if Document.Company.IndustryCode}}

Industry code: {{>Document.Company.IndustryCode}}

{{/if}}

{{if Document.Company.TaxRegistrationNumber}}

VAT number: {{>Document.Company.TaxRegistrationNumber}}

{{/if}}

{{/if}}

</scope>

<feed amount="32" />

{{/if}}

<feed amount="32"/>

Date: {{:~date(Document.Date, 'DD.MM.YYYY', 'en-IE', 'Europe/Dublin')}}

Hour: {{:~date(Document.Date, 'HH:mm:ss', 'en-IE', 'Europe/Dublin')}}

<feed amount="32"/>

<grid positions="0, 30">

<row>

<col width="20">

<bold>Change</bold>

</col>

<col>{{:~currency(Document.Change, ~root.CurrencyID)}}</col>

</row>

<row>

<col width="20">

<bold>Cash drawer openings</bold>

</col>

<col>{{>Document.CashDrawerOpenings}}</col>

</row>

<row>

<col width="20">

<bold>OpeningAmount</bold>

</col>

<col>{{>Document.OpeningAmount}}</col>

</row>

<row>

<col width="20">

<bold>ClosingAmount</bold>

</col>

<col>{{>Document.ClosingAmount}}</col>

</row>

<row>

<col width="20">

<bold>CashDepositsTotalAmount</bold>

</col>

<col>{{>Document.CashDepositsTotalAmount}}</col>

</row>

<row>

<col width="20">

<bold>Payments</bold>

</col>

<col>{{: Document.Payments ? Document.Payments.length : 0}}</col>

</row>

{{for Document.Payments}}

<row>

<col width="20">

{{>Type.Name}} ({{>Count}})

</col>

<col>{{:~currency(Amount, ~root.CurrencyID)}}</col>

</row>

{{/for}}

<row>

<col width="20">

<bold>Taxes</bold>

</col>

<col>{{: Document.Taxes ? Document.Taxes.length : 0}}</col>

</row>

{{for Document.Taxes}}

<row>

<col width="20">

{{>Name}} ({{:~rateToPercentage(Rate)}})

</col>

<col>{{:~currency(Amount, ~root.CurrencyID)}}</col>

</row>

{{/for}}

<row>

<col width="20">

<bold>Payments per employee</bold>

</col>

<col>{{: Document.PaymentsPerUser ? Document.PaymentsPerUser.length : 0}}</col>

</row>

{{if Document.PaymentsPerUser}}

{{for Document.PaymentsPerUser}}

<row>

<col width="20">

Employee(s) {{>UserID}} ({{>Count}})

</col>

<col>{{:~currency(Amount, ~root.CurrencyID)}} ({{>Description}})</col>

</row>

{{/for}}

{{/if}}

<row>

<col width="20">

<bold>Product groups</bold>

</col>

<col>{{>Document.ProductGroups.length}}</col>

</row>

{{for Document.ProductGroups}}

<row>

<col width="20">

{{>Code}} ({{>Count}})

</col>

<col>{{:~currency(Amount, ~root.CurrencyID)}}</col>

</row>

{{/for}}

<row>

<col width="20">

<bold>Number of discounts</bold>

</col>

<col>{{>Document.DiscountCount}}</col>

</row>

<row>

<col width="20">

<bold>Total discounts</bold>

</col>

<col>{{:~currency(Document.TotalDiscounts, ~root.CurrencyID)}}</col>

</row>

<row>

<col width="20">

<bold>Number of returns</bold>

</col>

<col>{{>Document.ReturnCount}}</col>

</row>

<row>

<col width="20">

<bold>Total of returns</bold>

</col>

<col>{{:~currency(Document.TotalReturnsAmount, ~root.CurrencyID)}}</col>

</row>

<row>

<col width="20">

<bold>Number of duplicate receipts</bold>

</col>

<col>{{>Document.CopyReceiptsPrinted}}</col>

</row>

<row>

<col width="20">

<bold>Total receipts</bold>

</col>

<col>{{:~currency(Document.TotalCopyReceiptsAmount, ~root.CurrencyID)}}</col>

</row>

{{* Grand totals *}}

<row>

<col width="20">

<bold>Grand total (cash payment)</bold>

</col>

<col>{{:~currency(Document.GrandTotalCash, ~root.CurrencyID)}}</col>

</row>

<row>

<col width="20">

<bold>Grand total</bold>

</col>

<col>{{:~currency(Document.GrandTotal, ~root.CurrencyID)}}</col>

</row>

<row>

<col width="20">

<bold>Grand total (returns)</bold>

</col>

<col>{{:~currency(Document.GrandTotalReturns, ~root.CurrencyID)}}</col>

</row>

<row>

<col width="20">

<bold>Grand total (excluding tax)</bold>

</col>

<col>{{:~currency(Document.GrandTotalNet, ~root.CurrencyID)}}</col>

</row>

</grid>

<feed amount="32"/>

Terminal: {{>TerminalCode}}

StationID: {{>StationID}}

Station name: {{>StationName}}

<feed amount="16"/>

<scope align="center">

<qrcode data="{{:ZippedSignature}}" size="6"/>

</scope>

<feed amount="16"/>

</report>

Automate generation of audit files

The CreateFinancialPeriodAuditTask could be configured to trigger generation of audit files at specific date/time. This task will basically do an automated generation of the audit files mentioned above in the start of step 9, which depicts the manual triggering of these audit files.

The following can be configured from the Scheduled tasks chapter, while filling in the fields as follows:

Type: EVA.Auditing.Tasks.CreateFinancialPeriodAuditTask

- Name: Any unique name you want

- Schedule: a cron value example, 0 4 2 * * . Test what you want your cron to look like here, then specify the exact value in this field i.e. the recurring point of time that would trigger this task.

- Settings

- Type: can be left blank

- Organization unit: the ID of the country that this report would pertain to i.e. The Irish organization unit type store.

- Email address: In case of task failures the email address you mention here will receive a notification. This is an optional field but quite handy.